aurora co sales tax 2021

ENTITY STATE RTD CD COUNTY CITYTOWN TOTAL. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

Register For A Sales Tax Permit In The State Of Virginia Business Solutions Virginia Sales Tax

You can print a 825 sales tax table here.

. Sales Tax Rate Change Summary Effective January 1 2022. The 825 sales tax rate in Aurora consists of 625 Illinois state sales tax 125 Aurora tax and 075 Special tax. The County sales tax rate is 475.

31 rows The state sales tax rate in Colorado is 2900. 2021COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY. Real championship 2021 long spine board controversy.

For tax rates in other cities see Illinois sales taxes by city and county. Did South Dakota v. If the due date 20 th falls on a weekend or holiday the next business day is considered the due date.

The exemption from City sales and use tax is eliminated with the passage of ordinance number 2019-64. The minimum combined 2022 sales tax rate for Aurora Colorado is 8. 2021 Rate Change NEW Combined rate beginning January 1 2022 Type of Local Tax.

The minimum combined 2022 sales tax rate for East Aurora New York is 875. Did South Dakota v. This is the total of state county and city sales tax rates.

1 Reduced collection of sales tax from certain businesses in the area subject to a Public Improvement Fee. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc.

What is the sales tax rate in Aurora Colorado. Aurora-RTD 290 100 010 025 375. Bright Home Investment Blog Uncategorized aurora co sales tax rate 2021.

The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. Download all colorado sales tax rates by zip code the aurora colorado sales tax is 290 the same as the colorado state sales tax. Aurora co sales tax rate 2021.

The Colorado sales tax rate is currently 29. View sales history tax history. This is the total of state county and city sales tax rates.

With local taxes the total sales tax rate is between 2900 and 11200. With CD 290 000 010 025 375. Colorado has recent rate changes Fri Jan 01 2021.

Method to calculate Aurora sales tax in 2021. The sales tax jurisdiction name is Aurora Arapahoe Co which may refer to a local government division. Colorado imposes a sales tax on retail sales of tangible personal property prepared food and drink and certain services as well as the furnishing of rooms and accommodations.

The Aurora sales tax rate is 375. 2 Rate includes 05 Mass Transit System MTS in Eagle and Pitkin Counties and 075 in Summit County. The average sales tax rate in Colorado is 6078.

In Alaska the sales tax rate is 0 the sales tax rates in cities may differ from 0 to 7. Select the Colorado city from the list of popular cities. Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month.

3 Cap of 200 per month on service fee. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. The County sales tax rate is 025.

While Colorado law allows municipalities to collect a local option sales tax of up to 42 Aurora does not currently collect a local sales tax. You can print a 85 sales tax table here. The East Aurora sales tax rate is 0.

Aurora colorado sales tax rate details the minimum combined 2021 sales tax rate for aurora colorado is 8. Annually if taxable sales are 4800 or less per year if the tax is less than 15 per month. 5 Food for home consumption.

This is the total of state county and city sales tax rates. The sales tax rate in aurora is 881 and consists of 29 colorado state sales tax. District Outside Business District 775 775 100 No change 875 775 Business District Aurora DuPage County Aurora Business District No.

The 800 sales tax rate in Aurora consists of 290 Colorado state sales tax 025 Adams County sales tax 375 Aurora tax and 110 Special tax. House located at 1166 S Nome St Aurora CO 80012 sold for 550000 on Nov 23 2021. The Aurora Colorado sales tax is 290 the same as the Colorado state sales tax.

The minimum combined 2022 sales tax rate for aurora colorado is 8. 1 Outside Business District 850 825 025. For tax rates in other cities see Colorado sales taxes by city and county.

The current total local sales tax rate in Aurora CO is 8000. The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax. The December 2020 total local sales tax rate was also 8000.

Method to calculate Douglas County sales tax in 2021. 4 beds 3 baths 2791 sq. The New York sales tax rate is currently 4.

The december 2020 total local sales tax rate was also 8000. 24 lower than the maximum sales tax in CO. This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing.

File Aurora Taxes Online. There is no applicable county tax. Depending on the zipcode the sales tax rate of aurora may vary from 675 to 85 every 2021 combined rates mentioned above are the results of colorado state rate 29 the county rate 025 to 075 the aurora tax rate 25 to 3.

Wholesale sales are not subject to sales tax. 4 Sales tax on food liquor for immediate consumption. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec.

The Sales tax rates may differ depending on the type of purchase. March 20 2021 March 20 2021 By world of cricket. Sales tax rates for arapahoe county.

The Aurora Sales Tax is collected by the merchant on all qualifying sales.

How Colorado Taxes Work Auto Dealers Dealr Tax

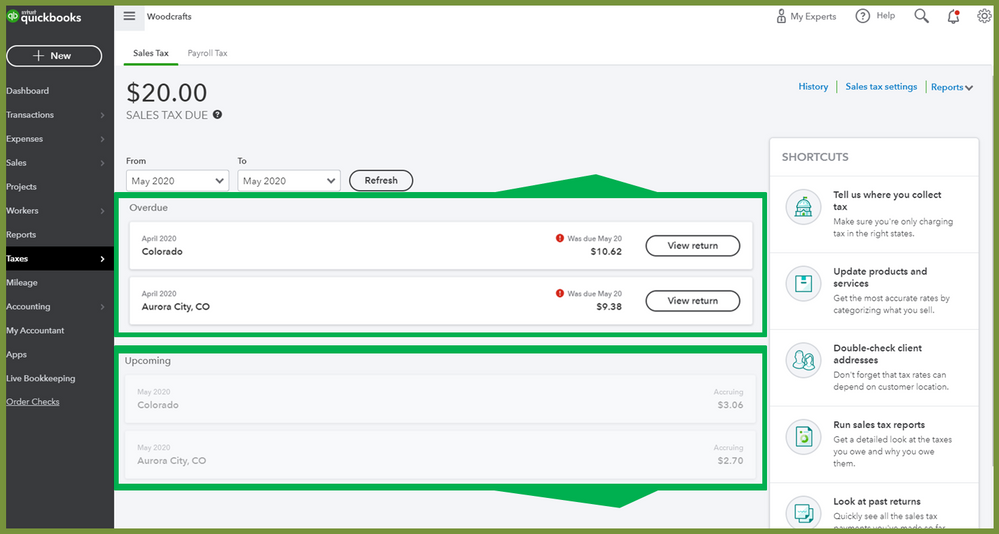

Set Up Automated Sales Tax Center

Sales Tax Rates Douglas County Government

How To File The Colorado Retail Sales Tax Return Dr 0100 Using Revenue Online Youtube

Illinois Car Sales Tax Countryside Autobarn Volkswagen

How Colorado Taxes Work Auto Dealers Dealr Tax

Colorado Sales Tax Rate Changes In April 2022

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

How To Apply For A Colorado Sales Tax License Department Of Revenue Taxation

We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs

How Colorado Taxes Work Auto Dealers Dealr Tax

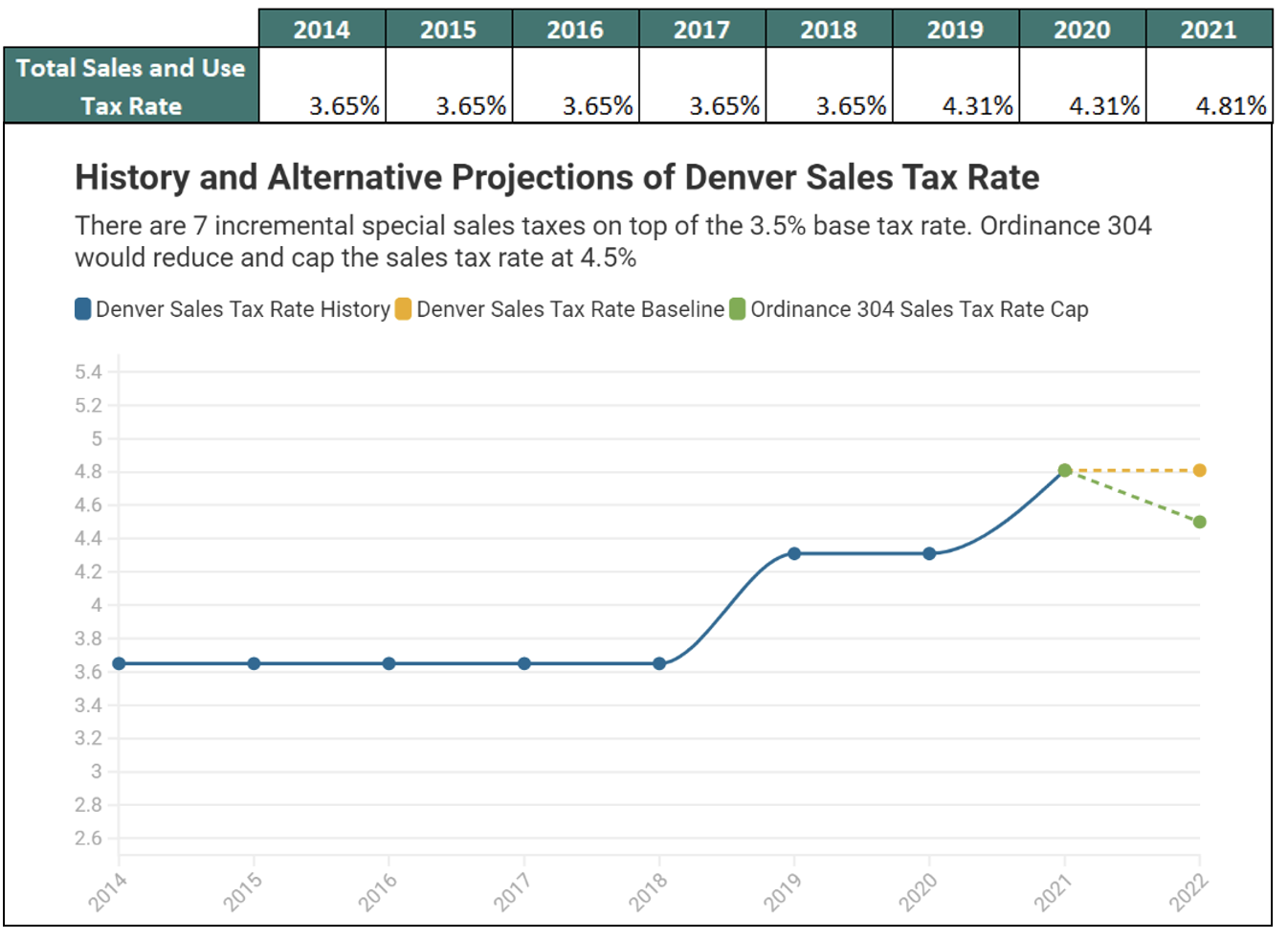

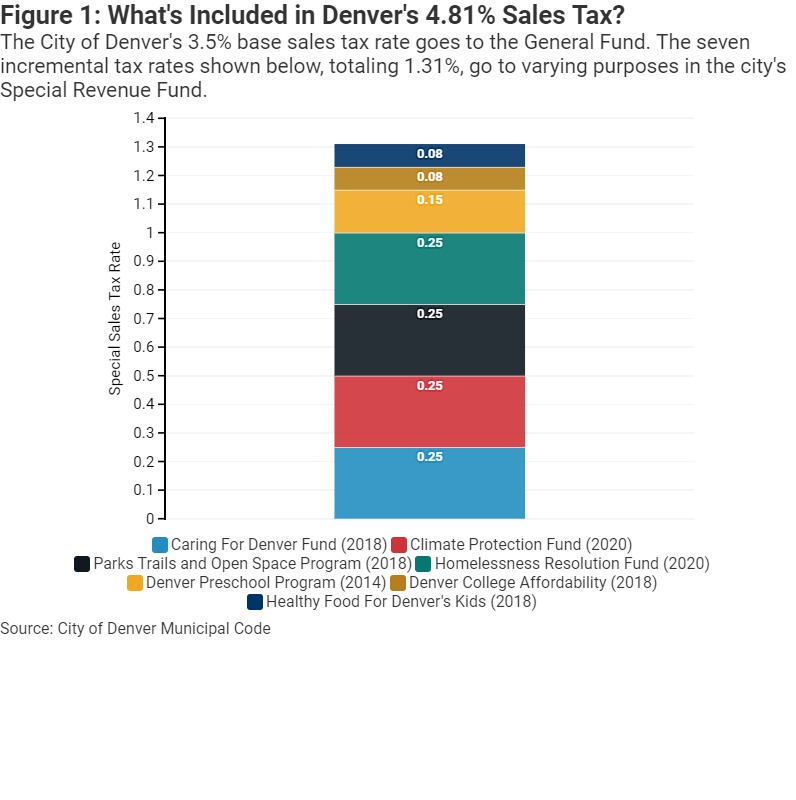

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

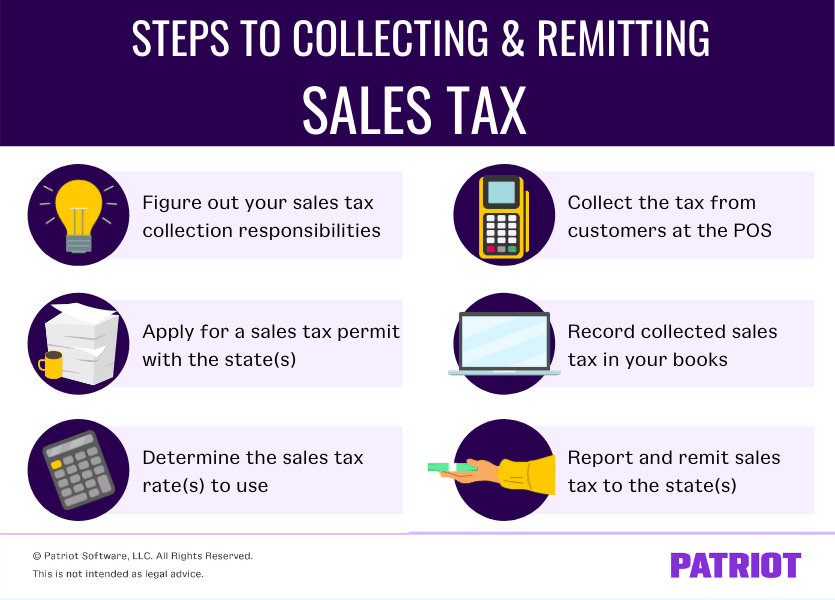

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Sales Tax Filing Information Department Of Revenue Taxation

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

23306 E 5th Pl 203 Aurora Co 80018 2 Beds 2 Baths In 2021 Home Home Decor Furniture